For this blog I would like to focus on bankers and their bonuses. I choose this topic as it seems rather vital to me, not just due to the recession but also due to peoples and the government’s reaction to it.

For this I have red several articles and was amazed to find how all of them were pro the possible new law coming out restricting the bankers bonuses in the United Kingdom and giving more power to the “people” and the government.

The law which was also discussed by the Queen and Gordon Brown should be passed through parliament at the next general elections, by June next year. The law would only be applicable to future contract which would make excessive bonus contracts void under the law. It would furthermore empower the FSA in controlling bonuses and calling contracts that encourage bankers to take risk by making their bonuses dependant on a certain return on investment. It would also reduce bonuses and no longer allow for millions to be spent on “pinstriped robbers”, who are reckless and failures that the public had to bail out. This in turn would allow for more security and accountability in the financial sector. Forgein banks operating within the United Kingdom shall also have to abide to this law, however other subsidiaries, even those of British banks will no not have to follow this law. Is that really fair? And how does this encourage someone to work in London and not for the same bank just in a different location?

The story has been regurgitated so often they i do not feel the need to go into the exact details of the new law but shall focus more on the styles and approaches the newspaper articles took for this story. The BBC story was the most straight forward and detailed article, however, it as well as the others had a clear pro this law and anti bankers attitude, stating that bankers should be “struck off the same way that doctors are struck off in the case of misconduct. The article also had a proud air to it, stating that the United Kingdom was the first to do this and this it was setting example by taking actions while other countries only talk about it. The articles uses a lot of quotes in their favour, against the bankers, although they do briefly mention that the bankers association believes that it might cause London to lose its power financial status and lose out on recruiting future talent. The author of the article seems to be thinking he is talking from a public perspective who has enough of the power that banks have, it also seems as though he has a personal grudge against banks, as he ends the article with how this law would give people the power to over banks and their high charges. The article also mentions that this law would hinder banks from encouraging customers to borrow more money than they can afford, neither may banks send out unrequested credit card checks. I believe that such restrictions, would cause banks to lose a lot of money, banks are pillars of our society that is why the government had to save them in the first place, so is it wise to weaken them? Having more transparent yes that is needed, put pulling the carpet away from underneath their feet might not be the right thing to do.

From reading the Times i thought that it was interesting that the parliament used the Queen and her influence over people to address the topic further. Although the Queen no longer has the power or support that the royal house once enjoyed, she still has some influence. This article had more and better details then the others with some good pro contra arguments. As this is a very debatable subject , if it back fires it could become a big problem, however looking at other students from this university or others, many of them still wish to be working in the financial sector, so maybe this will not have as big an effect as claimed. Or maybe it does and people will not want to work in England anymore but in other countries where these laws do not apply. The article creates some bad blood among the readers saying that bankers personally do not believe that this law shall hold up and that they shall always be loop wholes. Yet at the same time they state that the “trust between the people and financiers” is to be re-established. The article is trying to calm down the hatred that Bankers have received since the crises, a good example of this is the G20 summit held in London, where bankers were asked to work from home or to come into work with casual wear in order to hinder violence.

This articles also has a rather Interesting title, showing the power struggle that the government is experiencing with the banks. “Labour tries to tame...” taming, one tames a wild animal, have banks gone wild, have we not created more transparency, can they really blame all of it on the banks, they were allowed to roam free during the good years, so they are not the only ones to blame but the game keeper to.

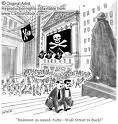

The Daily mail article was quite harsh on the bankers, calling them “pinstriped robbers”, portraying them as mobsters nearly, who need a “watchdog” over their shoulders, protecting the civilians from the criminals. The new law shall give the FSA the power to tear up bankers, not their contracts but the bankers, again seems like they are criminals where the government has to tear apart their lives to get to them. The article tries to create a lot of bad blood by quoting a lawyer who says that bankers shall never be touched, as the government does not have the calibre or muscle to take them down should bankers go to court. Saying that this new law is not enough, it is only a “blunt instrument”, and that it shall not stop bankers from “ripping off” the public and creating a win/win situation for themselves on every account. The article really calls upon readers to be outraged and angry at the big bad robbers and criminals we call bankers.

The telegraph took a different approach to the situation, they were not as harsh but still absolutely in favour of the government. Making the new law into a making it into a pretty little package, it seems to harmless what the state is doing. Saying that banks are rip offs for the public and this law will give the public more power. Stating that banks shall have to pay back and own up to thousands of customers. Although not as in your face style as the Daily mail, the telegraph is still hipping it up in order to obtain support. As this new law will cut individuals’ legal costs and give them added muscle against banks that levy unfair charges. Stating that this is a necessary measure as bankers believe themselves to be superior but that they are actually only “fellow citizens” that had to be bailed out of their failure.

The telegraph also awarded one article stating what bankers believe this new law should bring to the United Kingdom, however they still argue in favor of the law saying that it does not matter if talent is discouraged from coming to London, as it shall only discourage those who seek to take advantage and we do not want these in our country anyway.

Whatever the newspapers are saying i have to ask myself; is it really wise to give the government so much control, especially over the financial sector? In the long run this shall be in the public’s disadvantage, the state being able to access all your records etc.. Are we not already controlled enough? big brother seems to want to get into every part of our lives.

The sun articles was very weak , but again for the public and stating how this law will give them power and not stating it as it is, that it shall give the government power not the little man. They also had a clear disliking of bankers calling them “fat cats” and that the bonus system is “ludicrous”.

The comments on the paper from the readers were rather harsh, calling labour a failure and that no one believes that they can hold their weight for anything that they are just “suckers” and do not believe that this plan shall be good for business but that it is “alien to business success”.

S

Sources used:

BBC news

'Reckless' bankers face bonus cut

15.11.09

http://news.bbc.co.uk/1/hi/uk_politics/8361372.stm

Times Online

Labour tries to tame banks with plan to outlaw controversial bonuses

16.11.09

http://www.timesonline.co.uk/tol/news/politics/article6917982.ece

Daily mail

http://www.dailymail.co.uk/news/article-1229361/Reckless-bankers-contracts-torn-tough-new-laws-crack-bonuses.html

20.11.09

Reckless bankers will have contracts torn up in tough new laws to crack down bonuses.

Telegraph

Bankers warn laws on pay and bonuses will scare off talent

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/6576390/Bankers-warn-laws-on-pay-and-bonuses-will-scare-off-talent.html

15.11.09

The Sun

Block on bankers in bonus scandals

16.11.09

http://www.thesun.co.uk/sol/homepage/news/money/2731331/New-laws-mean-big-bonus-bankers-will-have-contracts-torn-up.html

Telegraph

Now State takes over bankers’ contracts

14.11.09

http://www.telegraph.co.uk/finance/6570841/Now-State-takes-over-bankers-contracts.html

.jpg)